how to avoid tax on 457 withdrawal

Withdrawals are subject to income tax. Ad Personalized Solutions Expert Help From Start To Finish.

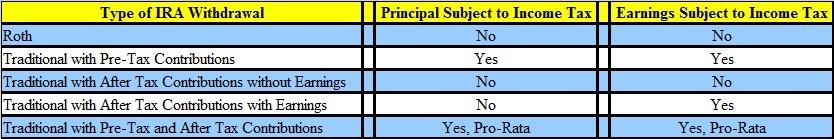

Roth Ira Withdrawal Rules Estime De Soi Releve De Compte Assurance Vie

We Can Help Suspend Collections Wage Garnishments Liens Levies and more.

. Can you withdraw money from a 457 B plan. Withdrawing money from a. For this calculation we assume that all contributions to the retirement account.

Ad Tip 40 could help you better understand your retirement income taxes. Colorful interactive simply The Best Financial Calculators. Ad What Are Your Priorities.

The early withdrawal penalty is a 10 penalty. The ability to avoid the early withdrawal penalty if. Market Trading Essentials March 12 2022.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Get Personalized Action Items of What Your Financial Future Might Look Like. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. If you meet the criteria for taking a distribution from. Ad What Are Your Priorities.

Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. Download 99 Retirement Tips from Fisher Investments. Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

The amount you wish to withdraw from your qualified retirement plan. Get a 457 Plan Withdrawal Calculator branded for your website. Ad If youre one of the millions of Americans who invested in stocks.

Start Resolving IRS Issues Now. With Merrill Explore 7 Priorities That May Matter Most To You. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old.

If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Even if your plan allows for a hardship distribution. 16 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be.

After taking out 12950 in standard deduction his first 10275 of taxable income will be taxed at 10 the remaining 31400 or ordinary income at 12 and because of his. 457 Plan Withdrawal Calculator. In addition to any taxes you owe on your withdrawal you will owe an additional 10.

A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions. As with a 401k plan you can get a tax deduction on. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Ad No Money To Pay IRS Back Tax. A 457 plan offers special tax benefits to encourage employees of government agencies and certain non-profits to save for retirement. There is no way to take a distribution from a 401 k without owing income taxes at the rate youre paying the year you take the distribution.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent. If you have a 457 b you can withdraw the budget from your account without any early withdrawal penalty. Get more tips here.

With Merrill Explore 7 Priorities That May Matter Most To You. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn.

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

How Can I Get My 401 K Money Without Paying Taxes

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

How To Withdraw From Your Traditional 401 K Account Early And Avoid Penalties And Fees

How Much Tax Do I Pay On 401k Withdrawal

A Guide To 457 B Retirement Plans Smartasset

Using The Rule Of 55 To Take Early 401 K Withdrawals Smartasset

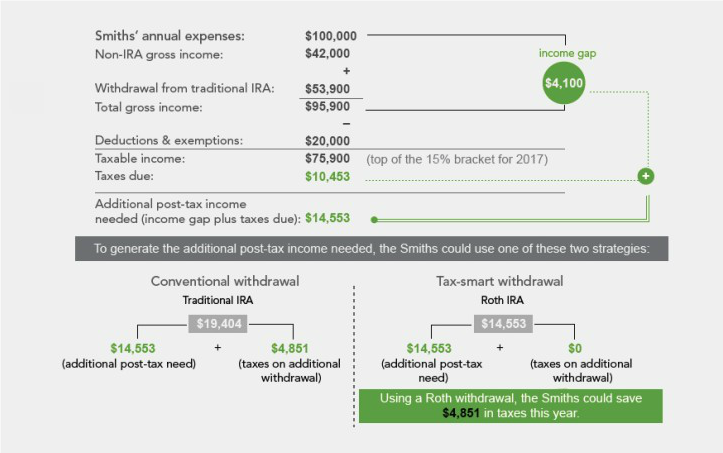

Four Tax Efficient Strategies In Retirement Fidelity Institutional

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Covid 19 Early Retirement Plan Withdrawal Taxes

Ira Early Withdrawal Penalties And Their Exceptions Toughnickel

457 Vs Roth Ira What You Should Know 2022

A Guide To 457 B Retirement Plans Smartasset

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

What Happens If I Withdraw Money From My Tax Deferred Investments Before Age 59 Coastal Wealth Management

How To Withdraw Money From Your 401 K Know Better Plan Better